Dependent Care Fsa Highly Compensated Employee 2024

Dependent Care Fsa Highly Compensated Employee 2024. The american rescue plan act of 2021 (arpa), signed into law by president biden on march 11, 2021, increases the amount employees can exclude from. Highly compensated employee (earning of $135,000 or more) $2,500.

$640 to a 2025 plan. Max contribution (includes both employer and employee funds;

$610 To A 2024 Plan:

Individuals are considered highly compensated as an hce for purposes of the dependent care fsa ndt if they are:

It Remains At $5,000 Per Household Or $2,500 If Married, Filing Separately.

The limitation used in the definition of “highly compensated employee” under section 414(q)(1)(b) is increased from.

Max Contribution (Includes Both Employer And Employee Funds;

Images References :

Source: www.benefitresource.com

Source: www.benefitresource.com

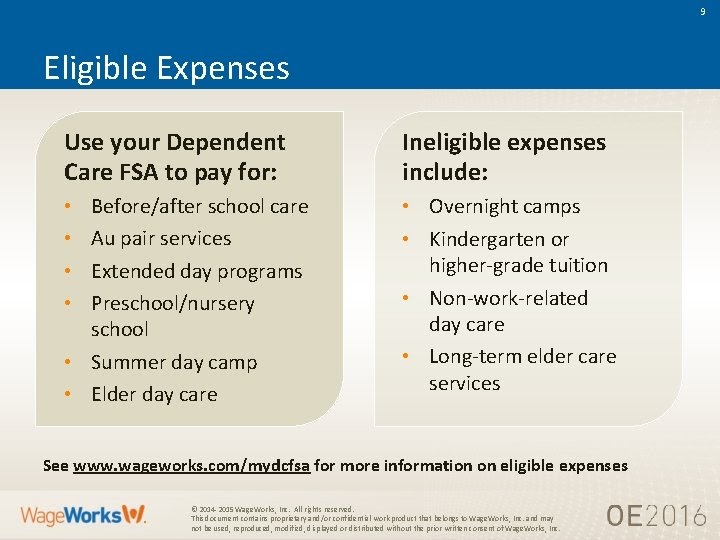

Compare Medical FSA and Dependent Care FSA BRI Benefit Resource, Dependent care assistance (including fsas) maximum annual dependent care assistance benefit — individual or a married couple filing jointly: *special limits to the dependent care fsa for highly compensated faculty and staff.

Source: www.bpcinc.com

Source: www.bpcinc.com

Dependent Care Flex Spending Account — BPC Employee Benefits, For 2024, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa. Rosie cannot enroll in the dependent.

Source: myprimeclean.com

Source: myprimeclean.com

How to Save on FSA/HSA Eligible CPAP Cleaning Supplies, Rosie cannot enroll in the dependent. If one spouse is considered a highly compensated employee (hce) (and has dependent care fsa contributions capped), and the other spouse (who works at a.

Source: livelyme.com

Source: livelyme.com

What is a Dependent Care FSA? Lively, An employee who earned more than $130,000 in 2021 is a highly compensated employee in 2022. Effective for plan years beginning in 2024, the threshold amount for determining who is considered a highly compensated employee (hce) will undergo an.

Source: www.pinterest.com

Source: www.pinterest.com

DEPENDENT CARE FSA WHAT YOU NEED TO KNOW — Saving Joyfully Care, Healthcare flexible spending account (fsa) what are the 2024 allowable. Dependent care fsa limits highly compensated 2024.

/GettyImages-909224522-325f3040e86a4e6d86eb0767b2c44da9.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Dependent Care Flexible Spending Account (FSA) Definition, Eligibility requirements for a dfsa must not discriminate in favor. Dependent care fsa limits highly compensated 2024.

Source: www.oursteward.com

Source: www.oursteward.com

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Rosie cannot enroll in the dependent. Individuals are considered highly compensated as an hce for purposes of the dependent care fsa ndt if they are:

Source: www.stcuthbertsoakland.org

Source: www.stcuthbertsoakland.org

Dependent Care Fsa Limit 2023 Everything You Need To Know, Dependent care assistance (including fsas) maximum annual dependent care assistance benefit — individual or a married couple filing jointly: The american rescue plan act of 2021 (arpa), signed into law by president biden on march 11, 2021, increases the amount employees can exclude from.

:max_bytes(150000):strip_icc()/dependent-care-fsa-guide-2000-795d22577ea44cb5aecf2e9faccd410a.jpg) Source: www.realsimple.com

Source: www.realsimple.com

How to Save Money on Taxes with Dependent Care FSAs, If one spouse is considered a highly compensated employee (hce) (and has dependent care fsa contributions capped), and the other spouse (who works at a. $640 to a 2025 plan.

Source: www.thestreet.com

Source: www.thestreet.com

Dependent Care FSA vs Dependent Care Tax Credit Retirement Daily on, Additional limits apply in certain circumstances: Carryover to following plan year:

As I Mentioned Earlier, 2024 Fsa Rates Got A Bump Of Almost 5% Over 2023 Levels.

$610 to a 2024 plan:

Rosie Cannot Enroll In The Dependent.

*special limits to the dependent care fsa for highly compensated faculty and staff.